Investment Objective

To generate optimal returns consistent with moderate levels of risk and high liquidity by investing in debt and money market instruments. There is no assurance that the investment objective of the Scheme will be achieved.

Fund Details

| Fund Name | Abakkus Liquid Fund | ||||||||||||||||

| Plans | Regular & Direct | ||||||||||||||||

| Options | Growth / Income Distribution cum Capital Withdrawal option (IDCW)-Reinvestment | ||||||||||||||||

| Minimum Application Amount/switch in |

Lumpsum investment: Rs.1000/- and in multiples of Re. 1/-

thereafter. Systematic Investment Plan (SIP): Rs. 500/- and in multiples of Re. 1/- thereafter with a minimum of 6 instalments. |

||||||||||||||||

| Minimum Additional Purchase Amount | Rs. 100/- and in multiples of Re. 1/- thereafter. | ||||||||||||||||

| Minimum Redemption/ switch out amount |

Redemption- Rs. 100/- or 1 Unit or account balance whichever

is lower. Switch Out- Rs. 500/- and in multiples of Re. 1/- thereafter. |

||||||||||||||||

| Exit Load |

|

||||||||||||||||

| Benchmark Index | CRISIL Liquid Debt A-I TRI |

Fund Manager

Head of Investments and Research

+ Years of

overall experience

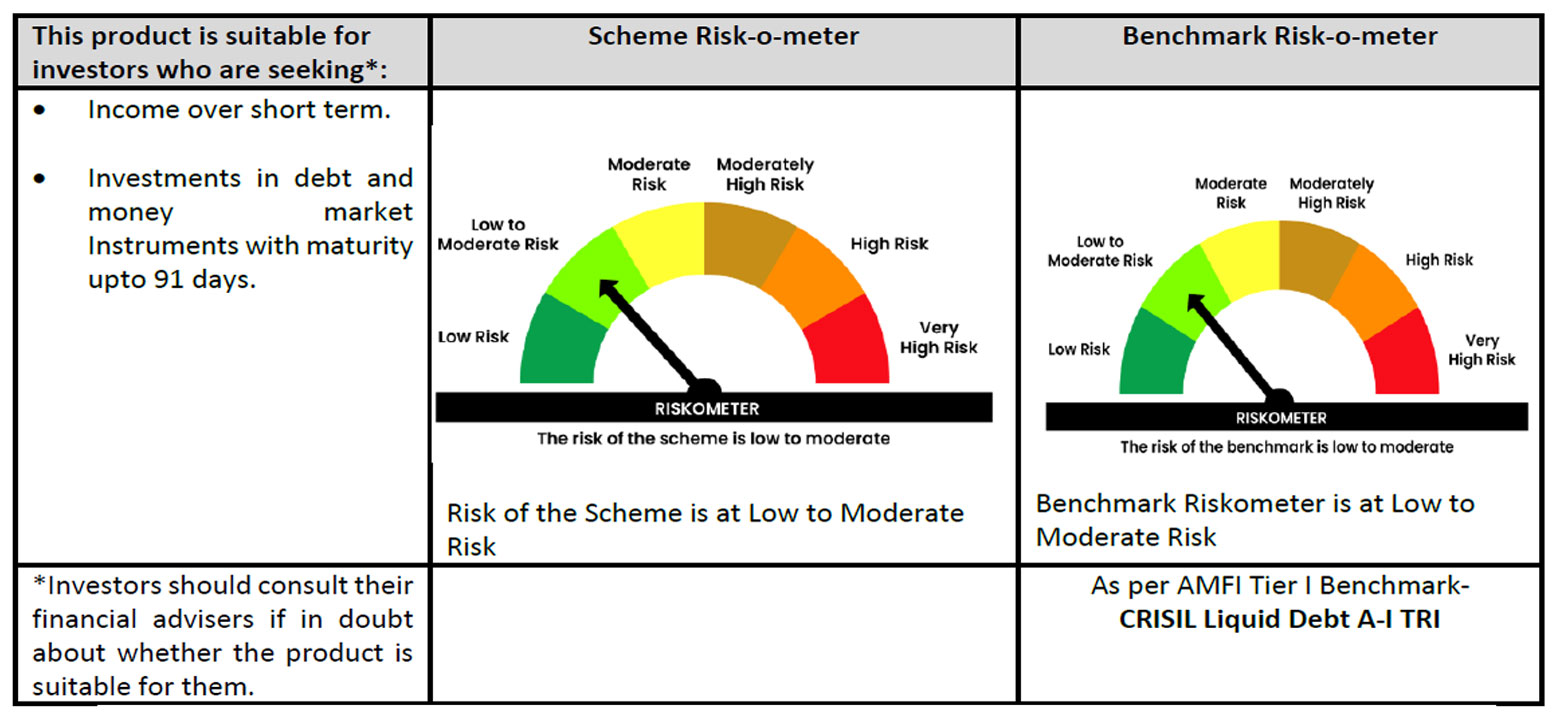

Risk-o-Meter and Product Suitability Label

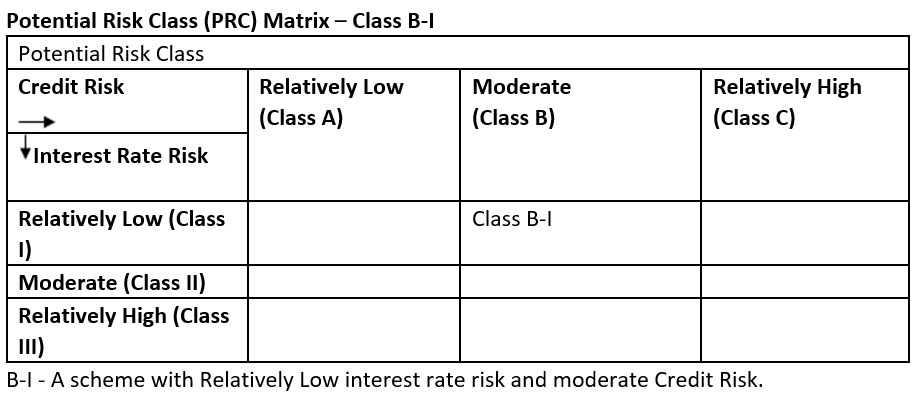

Abakkus Liquid Fund

(An open-ended liquid scheme - a relatively low

interest rate risk and moderate credit risk)

“The above product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made.”

Offer for Units of Rs. 100/- each for cash during the New Fund Offer and Continuous Offer for Units at NAV based prices.

Scheme Documents

Abakkus Liquid Fund FAQs

Its investment objective is to generate optimal returns consistent with moderate levels of risk and high liquidity by investing in debt and money market instruments. There is no assurance that the investment objective of the Scheme will be achieved.

Note: This product labelling is assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

For risk-o-meter of the scheme, visit https://www.abakkusmf.com/liquid-fund.html

Investors can undertake transactions via electronic mode through various online (BSE, NSE, MFU, MF Central) and AMC Website and other platforms specified by the AMC from time to time.

Investors can refer offer documents for more details on facilities such as SIP/SWP/STP, etc.

- Minimum Lumpsum Investments applicable for this fund is ₹ 1000/-

- Minimum Additional Investments applicable for this fund is ₹ 100/-

- Minimum Systematic Investment Plan (SIP) applicable for this fund is ₹ 500/-

1. Regular Plan

2. Direct Plan

- Each of the Plans shall have two options:

1. Growth

2. Income Distribution cum capital withdrawal option (IDCW) - Reinvestment.

No lock-in period is applicable for this fund.

The Fund Manager of Abakkus Liquid Fund is Mr. Sanjay Doshi, having an overall experience of 20 years in fund management and research.

| Investment period i.e. number of days from the date of subscription NAV | Exit load as a % of redemption proceeds |

| 1 Day | 0.0070% |

| 2 Days | 0.0065% |

| 3 Days | 0.0060% |

| 4 Days | 0.0055% |

| 5 Days | 0.0050% |

| 6 Days | 0.0045% |

| 7 Days or more | Nil |

Note: For the purpose of levying exit load, if subscription (application & Funds) is received within cut off time on a day, Day 1 shall be considered to be the same day, else the day after the date of allotment of units shall be considered as Day 1.

No exit load shall be applicable on switches from Regular Plan to Direct Plan, and vice versa under the scheme.

No load will be charged on units issued upon re-investment of amount of distribution under same IDCW option.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.